Tesla’s recent performance in the stock market has delivered a significant blow to short sellers, resulting in an estimated loss of $3.5 billion. This follows the electric vehicle (EV) manufacturer’s better-than-expected second-quarter delivery report, which saw a marked increase in stock value, causing substantial mark-to-market losses for those betting against Tesla.

Short sellers, who profit by borrowing shares to sell at higher prices with the aim of repurchasing them at lower prices, have been caught off guard by Tesla’s recent uptick. Despite Tesla’s sales declining for the second consecutive quarter—down 4.7% from the same period last year—the company managed to surpass Wall Street’s delivery forecasts. Analysts had predicted 439,000 deliveries, but Tesla reported 443,956, triggering a 22% rise in the stock since Monday.

Currently, short interest in Tesla stands at 3.3% of the float, translating to 105.38 million shares. This unexpected surge in stock price has particularly impacted traders who anticipated a continued decline in Tesla’s performance.

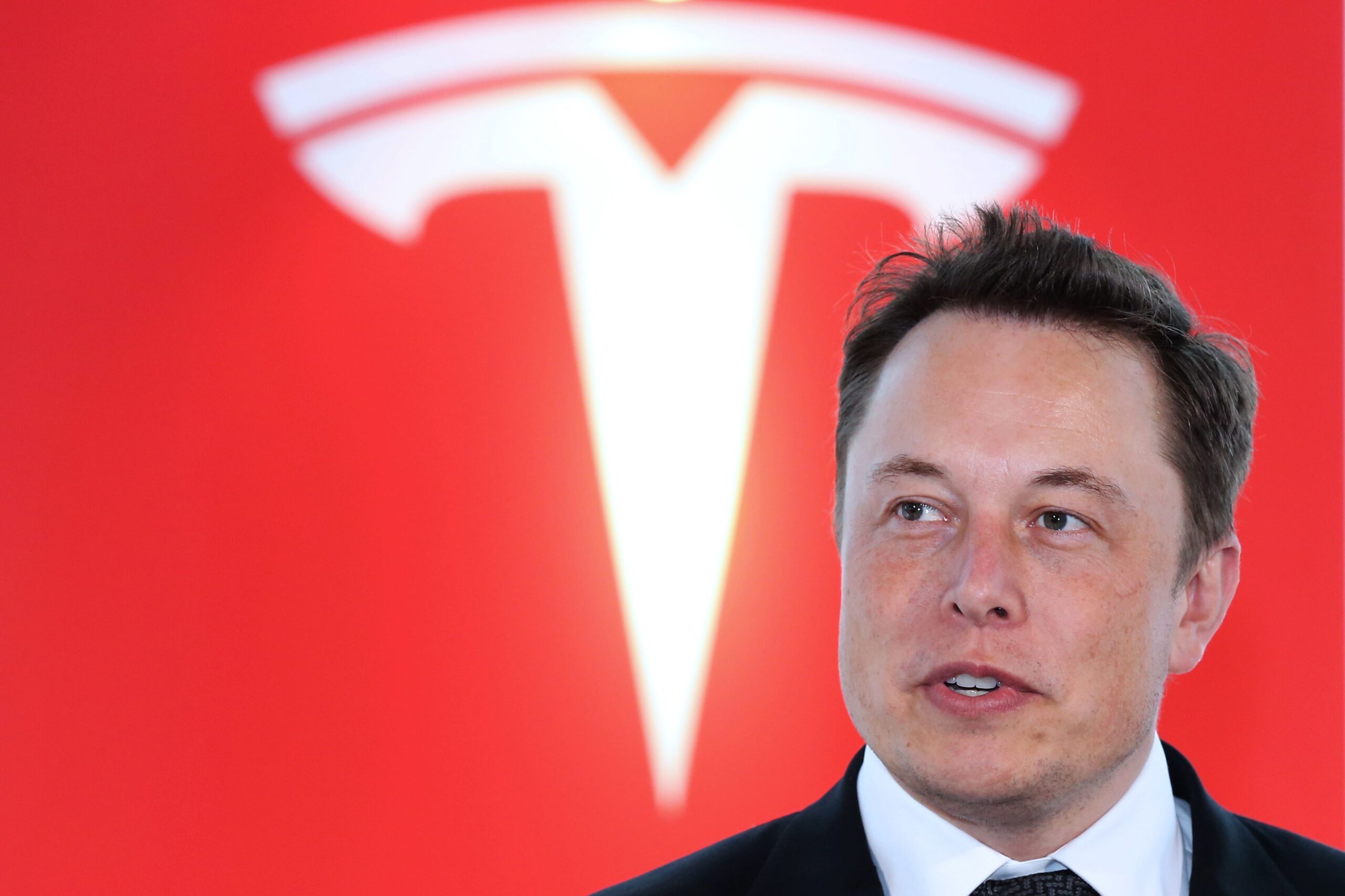

CEO Elon Musk (picture), known for his active presence on social media, did not miss the opportunity to address short sellers. Following the positive delivery report, Musk took to social media, emphasizing the superiority of Tesla’s autopilot capabilities and reaffirming his commitment to the company, highlighting that Tesla is the only publicly traded stock he holds. In a direct message to short sellers, including notable figures like Bill Gates, Musk warned that those betting against Tesla would face significant losses once the company fully resolves its autonomy issues and begins mass production of its humanoid robot, Optimus.

Tesla’s Full Self-Driving (FSD) software, initially released in beta in 2020, remains at industry standard Level 2, requiring human oversight. Optimus, Tesla’s humanoid robot, is projected by Musk to be of immense value, potentially surpassing all other Tesla products combined, with a tentative release date set for next year.

Despite the challenges in its core automotive business, including an aging product lineup and intensified competition, Tesla continues to innovate. The company has been aggressively incentivizing purchases through discounts, low-interest financing, and other perks. For instance, Tesla offered zero-interest loans in China and slashed prices in Germany and Norway during the second quarter. In the U.S., Tesla provided a three-year, 2% APR financing deal for its rear-wheel-drive Model 3.

Tesla’s upcoming earnings report, scheduled for July 23, will offer deeper insights into the company’s financial health. Analysts are anticipating earnings per share of $0.60, a slight increase from previous estimates. However, the company has faced three consecutive quarters of revenue decline, including a 9% drop year-over-year in the most recent quarter.