CAPBAY, an award-winning Multi-Bank Supply Chain Finance platform and P2P platform became the first and only fintech selected to be part of national telecommunications giant Telekom Malaysia Bhd’s (TM) Vendor Financing Programme known as PERINTIS. CapBay will provide fast, affordable and fair access to supply chain finance solutions, bridging the cash flow gap for all levels and sizes of vendors throughout TM’s supply chain, including its SME subcontractors.

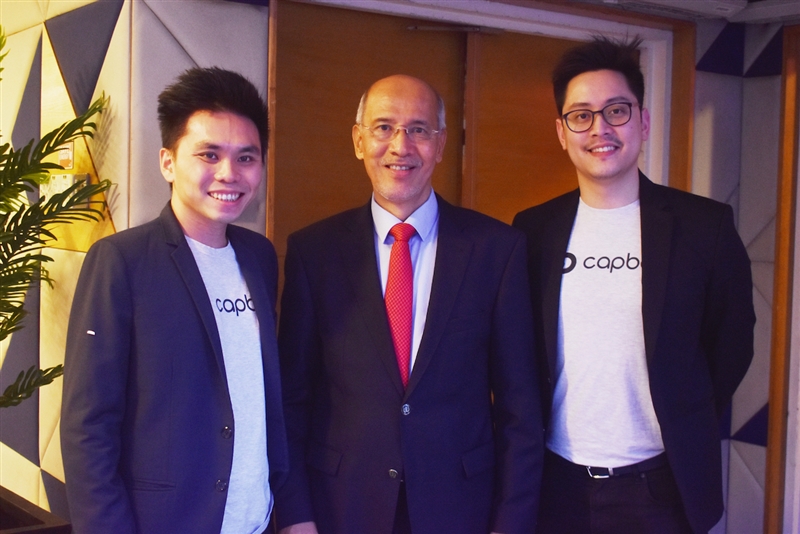

The MOU was signed yesterday by Imri Mokhtar, Group Chief Executive Officer of TM and CapBay’s CEO, Ang Xing Xian alongside other representatives from a panel of distinguished banks. The signing ceremony was witnessed by YB Dato’ Sri Dr Hj Wan Junaidi Tuanku Jaafar, Minister of Entrepreneur Development and Co-operatives, accompanied by Tan Sri Dato’ Seri Mohd Bakke Salleh, Chairman of TM.

“SMEs stand to benefit the most from this innovative programme as a large majority of TM’s vast network of nationwide vendors are SMEs” said Tan Sri Mohd Bakke Salleh, Chairman of TM Bhd in his speech at the Memorandum of Understanding (MOU) signing ceremony. “TM’s PERINTIS programme is in line with the government’s efforts to ensure that vendors can expand their job opportunities. As you are aware, SMEs are the backbone of the country’s economy, accounting for two thirds of employment and almost 40% of the economy. Therefore, it is important to ensure that they are able to face the challenges of the economic pressures plaguing us today”, said YB Dato’ Sri Dr Hj Wan Junaidi Tuanku Jaafar, Minister of Entrepreneur Development and Co-operatives during his speech.

Telekom Malaysia Bhd is the latest blue-chip corporate to implement CapBay’s flagship Supply Chain Finance platform

“We are pleased to partner with TM and be part of PERINTIS, expanding our reach to underserved SMEs in the telecommunication sector that need flexible working capital to grow their business and build resilience against the impacts of COVID-19,” said Ang Xing Xian, CEO of CapBay. “With TM’s assistance in authenticating relationships and transactions, vendor processing requests will be digitised end-to-end, making risk assessment, onboarding and transactional financing simpler and faster,” added Ang.

Partnership expands investment opportunities for CapBay’s P2P platform for a safer asset class with healthier returns

With this latest initiative, CapBay’s P2P investors can now expand and diversify their investment portfolio backed by government and large corporate receivables while earning healthier returns. CapBay differentiates itself by offering lower risk investment notes in a bid to enhance investor trust and confidence especially during these times of uncertainty brought about by the COVID-19 pandemic.

“With the recent OPR cuts, investors are worried that they will see lower returns on their investments and are looking for higher yielding investments that are relatively safe. At our core, we strive to offer P2P investors high quality investment notes that offer good yield and low financing loss risk. Investors can consider this as an alternative to fixed deposit savings,” added Ang.

Through CapBay’s proprietary credit-decisioning model, CapBay is able to provide flexible and cost-effective financing to SMEs and at the same time contain credit risks with a good track record of low financing losses, making it an overall safer alternative investment. CapBay launched their P2P financing pilot programme in March 2020 amid the COVID-19 pandemic and has since achieved over RM20 million of financing over 150 notes while maintaining zero defaults and financing losses for their investors. Their tech solution has also been recognised and they were recently lauded as the “Fintech Startup of the Year” at The Asset Triple A Awards 2020.