The Conditional Movement Control Order (CMCO) was announced on May 1st effective on Monday, May 4th. As Netizens raised concerns over the potential increase in infections, businesses are rushing to put safety measures in place and prepare for reopening over the short notice. Several states have taken a stance to either opt out entirely or revise the CMCO for tighter control. The 7th edition of this study covers chatter about the CMCO, reactions and stances taken by individual states, compulsory screening for all foreign workers, highlights on four selected industries, and top trending topics among Netizens during this period.

With an estimated loss of RM 2.4 billion per day of MCO, the government announced the CMCO effective May 4th to reopen most businesses. The rushed announcement was made on Friday, May 1st with only three days for businesses and workers to prepare. The movement restrictions have also been eased with conditions, allowing two people in a car, travel distance more than 10km, allowing stranded Malaysians to return to their home or workplaces, and limited sports activities. The reopening of businesses also highlighted another concern over the finances of affected citizens.

The gap between the public’s spending capacity becomes apparent when we look into social chatter, typically industries that are considered as non-essential or a luxury. This edition’s study covers the Telco, Local Fashion, Gold Jewellery, and Beer industries, angled to derive insights from trends of chatter among consumers when it comes to non-essentials and luxuries. Providing insights into the proportion of Netizens who are financially comfortable during the MCO, and indirectly indicate the proportion of those who are not.

While communications are a necessity, multiple telco packages were offered in line with Stay Home campaigns during the lockdown, providing greater access and bandwidth to users but what of users who now will spend more time at work and dread the additional expense. On the other hand, the local fashion and gold jewellery guys who were pretty stagnant during lockdown have seen increasing interest as the festive season draws near. With hope for the MCO to conclude before Hari Raya, a considerable portion of Netizens including non-Muslims are preparing to celebrate the festive season in the new norm.

Wisesight’s Founder and Regional Director of APAC, Shakthi DC said, “Engagement data in relation to these industries can be used to assess the economic impact on target markets. After almost two months in lockdown, Netizens appear to have had a shift in priorities, where self-reflection has increased individuals’ needs towards personal well-being across the dimensions of physical, emotional, and financial health and security. This is indicated through the uptake of essential supplies while comfort and luxury were compromised during lockdowns

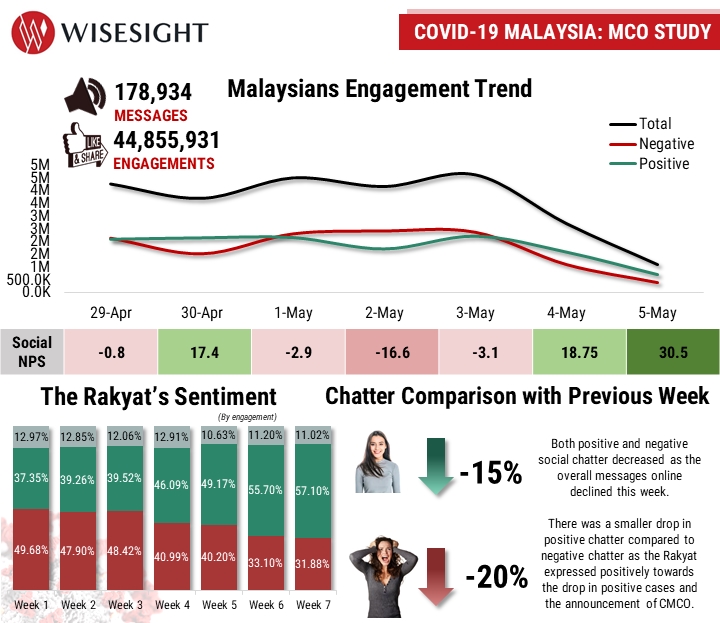

A STUDY BY WISESIGHT: COVID19 MCO IMPACT ON MALAYSIANS – Week 7

Depending on how quickly a vaccine is identified, when the economy picks up and People as individuals begin feeling secure again, it’s likely that the Luxury segment and Brands offering high-value assets will suffer as People make cutbacks due to the effects of Covid19 and are shaping up to be the last segments to recover.”

She added, “The reopening of the economy will unquestionably bring back some volume in traffic and transactions, albeit with changes in consumer buying behaviours. Businesses that have adapted and remained in touch with their audiences throughout the lockdown will find it easier to engage with their customers post-MCO. Purely because brand loyalty and affinity was actively maintained throughout the lockdown, and the results will show in the target audience’s response. Also considering the heightened fear of infection, organisations that create environments and processes with reduced physical contact, increased hygiene and safety measures will continue to gain public support as we embrace the new norm.”

Wisesight’s study details the events from 29th April – 5th May analysing the reactions and impact of these changes in comparison to findings from the previous weeks. The latest study includes:

- Netizens reactions to the CMCO

- Stances taken by individual states regarding the CMCO

- Top Malaysian’s concerns over the past seven weeks

- Current trending topics Malaysians shared online

- Selected Industries’ performance during the MCO (Telco, Local Fashion, Gold Jewellery, and Beer)

- Best practice recommendations for Brands content strategy

- Case Study – Communications and strategies adopted by highlighted industries to retain market share during the MCO

- Other stories of key interest among Malaysians during the period analysed

Fill up this form in order to automatically receive the Week 7 study in your inbox https://forms.gle/GKVW7sAYM4AbriEHA. This will be the last study in the series. If you missed out on the previous studies, you can download them here bit.ly/WSMCOStudy and follow Wisesight’s LinkedIn page.

Wisesight has a multitude of social intel tech solutions and custom objective research services serving the APAC market and can be contacted through [email protected] for similar studies, brand or industry studies that enable people centric data based decision making.