Bob Iger, CEO, The Walt Disney Company

Scott Mlyn | CNBC

It might seem like media companies are finally embracing the future as nearly every major programmer is launching a streaming service.

But examining the streaming products of AT&T’s WarnerMedia, Disney and Comcast’s NBCUniversal in isolation, a different concept reveals itself.

The giants of media are tailoring their offerings around their relative strength in traditional pay-TV. The pricing and roll-out strategies of streaming services are linked to how much media companies have to gain, or lose, if consumers start relying on streaming video in lieu of cable TV. As much as the old media giants might envy Wall Street’s years-long love affair with Netflix, the cable bundle still rules.

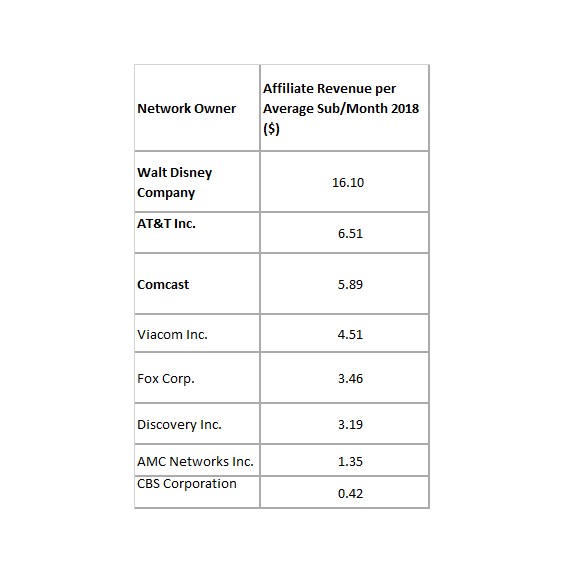

This chart explains the situation clearly. It shows approximately how much each media company currently generates from the cable networks it owns within the standard bundle. Pricing estimates come from SNL Kagan, a research arm of S&P Global Market Intelligence.

For example, for Disney, that’s ESPN and all of the associated ESPNs (ESPN2, ESPNU, etc.) plus the Disney channels, FX, National Geographic and its other owned networks (not including ABC, for which it gets additional broadcast retransmission fees). For that entire bundle, Disney makes more than $16 per cable subscriber per month. In other words, if you pay for a standard cable package, $16 of what you’re paying per month goes to Disney.

AT&T’s WarnerMedia networks, led by TNT, CNN and TBS, bring in about $6.50 per cable customer per month.

Comcast’s NBCUniversal networks — which include CNBC, as well as USA, Bravo, MSNBC, and others — earn a little less than $6 per person. The chart doesn’t include regional sports networks, many of which are owned by Comcast, or a la carte offerings like CBS’s Showtime or AT&T’s HBO, which aren’t part of a standard package.

All of this is important because it helps explain the business considerations behind the streaming wars, which kick off in earnest this fall.

The three most significant new streaming services from legacy media companies are WarnerMedia’s HBO Max, Disney+ and Comcast’s Peacock.

Disney+ will be first out of the date, with a debut on Nov. 12. WarnerMedia will officially unveil HBO Max, its streaming offering, at an event in Burbank, California, on Oct. 29, and it’s going to be available in the first half of 2020. Peacock is coming out around the same time.

Let’s take a look at these companies different strategies, ranked on a continuum from “most cool with your canceling cable” to “least cool with your canceling cable.”

Most cool with your canceling cable: HBO Max

AT&T has taken the most aggressive position with its streaming offering in terms of preparing for a world without traditional pay-TV.

WarnerMedia already sells HBO outside the cable bundle, charging $14.99 (call it $15) a month. It has 35 million U.S. subscribers, most of whom watch as an add-on to a traditional pay TV package.

Apart from that, the…

https://www.cnbc.com/2019/10/27/how-att-disney-and-comcast-are-handling-the-move-to-streaming.html