Google parent company Alphabet reported third-quarter earnings that missed earnings per share expectations but was otherwise in line with what investors expected.

The company’s stock fell as much as 4% in after hours trading, but recovered and settied down around 2%.

Here’s how the company did in comparison to analysts’ expectations:

- Earnings per share: $10.12 vs. $12.42 per share expected, per Refinitiv consensus estimates.

- Revenue: $40.5 billion vs. $40.32 billion expected, per Refinitiv consensus estimates.

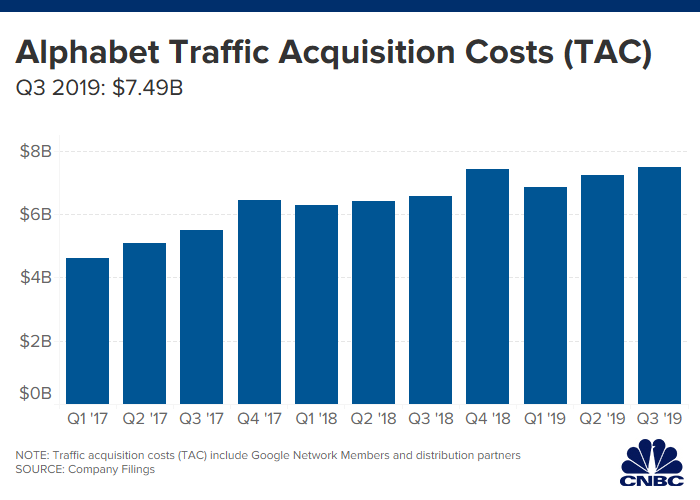

- Traffic acquisition costs: $7.49 billion vs. $7.48 billion, according to FactSet.

- Paid clicks on Google properties from Q3 2018 to Q3 2019: 18%

- Cost-per-click on Google properties from Q3 2018 to Q3 2019: -2%

The company met expectations on traffic acquisition costs. The metric represents the payments Google makes to companies like Apple for its search engine to be the default browser on their devices. It’s a key figure that analysts and investors look at to assess the health of Google’s business.

“We’ve evolved from a company that helps people find answers to a company that helps you get things done,” Google CEO Sundar Pichai said on a call with analysts.

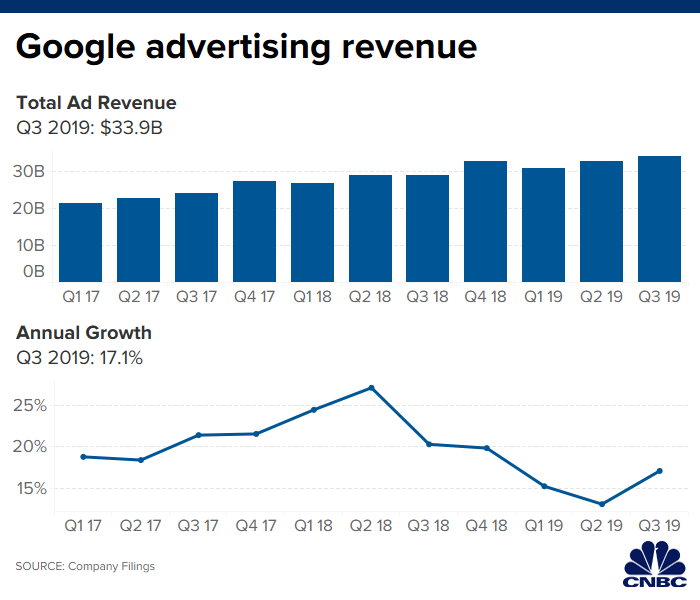

Google’s advertising revenue hit $33.92 billion in Q3, compared to $28.95 billion in Q3 of last year. Advertising still makes up the vast majority of Alphabet’s revenues. Pichai said that half of advertisers’ Search spend is now from automated bidding.

Google’s “other revenue,” which includes hardware like its Pixel phones and cloud products, came in at $6.43 billion, surpassing expectations of $6.32 billion, according to Factset. The company earned $6.18 billion last quarter and $4.64 billion in last year’s Q3.

In a call with CNBC, CFO Ruth Porat declined to comment on reports today that the company has made a bid to buy fitness-tracking device company Fitbit. An acquisition of that nature would make Alphabet a player in the wearable fitness tracking space, competing against the likes of Apple.

Alphabet said its revenue from “other bets,” which includes its subsidiaries outside of Google like the self-driving car company Waymo, came in at $155 million, which was more than last year’s Q3 $146 million in the year-ago quarter. It lost $941 million during the quarter, up from a loss of $727 million a year ago.

“We’ve always stressed that this is a long-term opportunity. We are pleased with the ongoing progress and each quarter we try and give you a sense of the steps along the way,” Porat told CNBC about Waymo. “Safety is the most important element when it comes to Waymo, so we are building out the business slowly and in an iterative fashion, and we are pleased about the ongoing progress there.”

Capital expenditures increased from $5.28 billion in the year-ago quarter to $6.73 billion as the company expands in Silicon Valley and other areas.

In July, Google CEO Sundar Pichai said the company plans to triple the sales force in cloud, and called it a key growth driver for Alphabet, revealing that it pulls…

https://www.cnbc.com/2019/10/28/alphabet-googl-earnings-q3-2019.html