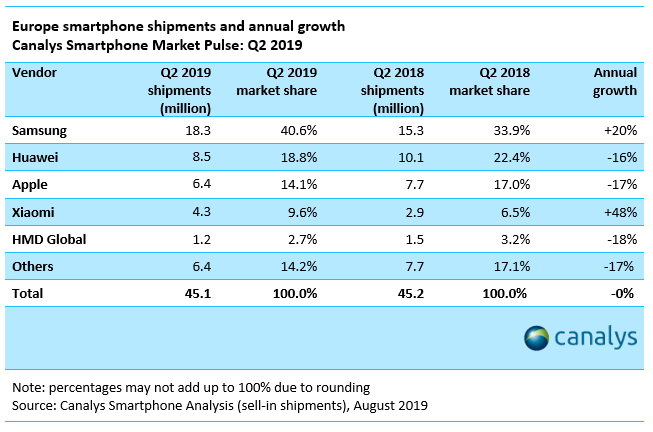

The European smartphone market is extremely fast-moving — model loyalty is not excessive, particularly with customers of lower-end gadgets. When you evaluate this 12 months’s second monetary quarter with the identical interval from final 12 months, you’ll be able to see how shortly issues change. Samsung and Xiaomi are clear winners in Q2 2019 with 20% and 48% annual development respectively, whereas Apple, Huawei, and HMD Global (Nokia) market shares shrank by a minimum of 16%.

Samsung accounted for about 40% of the market with 18.Three million shipments, up from simply 34% in 2018. Even although the corporate struggled internationally final quarter, its European enterprise continues to construct on its sturdy basis. Analyst agency Canalys sees the corporate’s revamped mid-range machine lineup as a number one explanation for the Korean firm’s surge:

It has introduced a blitz of aggressive new gadgets to market, focusing on its A collection, which accounted for over 12 million items. Its high 4 fashions in this vary, the Galaxy A10, A20e, A40, and A50, collectively shipped extra items than some other vendor in Europe managed with their whole vary of smartphones.

Huawei’s US commerce ban troubles are deemed one more reason for Samsung’s sturdy return: “Samsung has been quick to capitalize on Huawei’s US Entity List problems, working behind the scenes to position itself as a stable alternative in conversations with important retailers and operators.”

With Huawei dropping floor, it is left room for one more Chinese firm to make large features in the European market. Xiaomi’s 48% rise in shipments takes it to a market share of 10%, which is especially attributed to carriers and retailers attempting to maintain Samsung in examine, as Canalys Analyst Mo Jia says: “Distributors, retailers, and mobile operators are actively seeking alternative brands to fill the gap and reduce their dependence on Samsung.”

HMD Global – which solely began promoting Nokia-branded telephones in 2017 – noticed its market share shrink to a mere 3% final quarter. The firm’s complicated naming scheme, plethora of virtually indistinguishable gadgets, and lack of a compelling flagship are stopping HMD from promoting as many telephones as it’d hope to.

Even although Apple’s market share has fallen by round 3%, its most fairly priced latest telephone nonetheless stays in the highest 5 Q2 bestsellers — the iPhone XR is in fifth spot behind three Galaxy telephones (A50, A40, A20e) and Xiaomi’s Redmi Note 7.

https://www.androidpolice.com/2019/08/13/samsung-and-xiaomi-capitalize-on-huaweis-woes-to-increase-smartphone-market-share-in-europe/