Apple aimed to make the Apple Card accessible to as many individuals as doable and there have been experiences of individuals with credit score scores within the 600s being authorized, however there are nonetheless the reason why somebody may get denied.

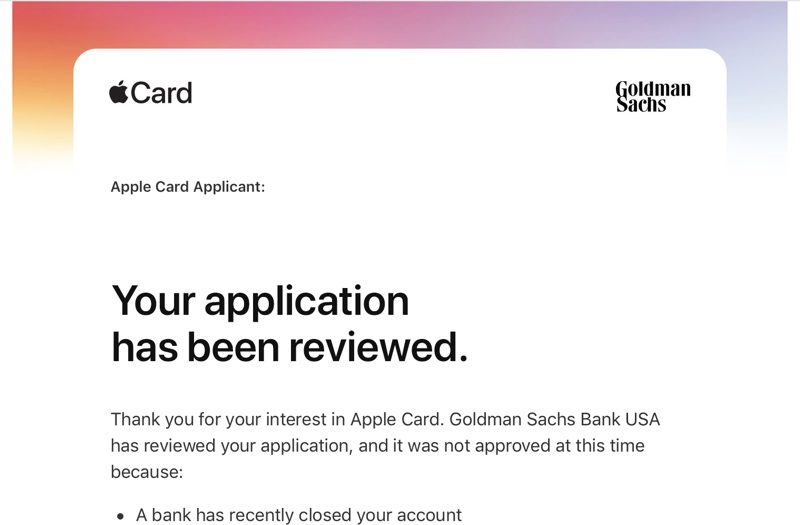

In a brand new help doc shared right now, Apple outlines the varied the reason why somebody is perhaps declined, together with low credit score rating, frequent bank card purposes, heavy debt and low earnings, tax liens, chapter, property repossession, overdue debt obligations, a latest checking account closure by a financial institution, overdue medical debt, and extra.

Apple’s help doc has an in depth checklist of explanations for individuals who had been declined, and whenever you apply for Apple Card, if you’re declined by Goldman Sachs (Apple’s accomplice) you will get a purpose why so you may cross reference it right here for extra data.

The doc additionally explains how credit score scores are decided (debt funds, exhausting credit score inquiries, debt degree, credit score age, open loans, and extra), and it particulars how clients can get a free credit score rating copy and dispute errors with TransUnion if mistakenly declined for a card. Apple recommends clients test for widespread errors that may be included in a credit score report if there’s a difficulty.

For clients who had been declined as a result of their id couldn’t be verified, Apple provides a number of suggestions similar to verifying that software data is correct and ensuring ID scans (when requested) are clear and embrace an ID that is not expired and with a final title that matches the appliance.

When requesting an Apple Card, Goldman Sachs does a delicate credit score test that doesn’t affect your credit score rating. Being declined or declining Apple’s provide won’t require a tough inquiry, which is barely finished whenever you truly settle for the Apple Card.

Apple says that credit score restrict is decided by earnings and minimal fee quantities related to present debt, which is used to evaluate means to pay.

Right now, Apple Card is proscribed to clients who’ve obtained an invitation from Apple, however Apple seems to be sending out various invites to those that have signed as much as be notified about Apple Card on the Apple Card web site. A large launch for Apple Card may come within the subsequent few weeks.

For extra on how Apple Card works and what you may anticipate, be certain that to take a look at our detailed Apple Card information.

https://www.macrumors.com/2019/08/14/apple-card-declined-support-document/