Apple may not be turning right into a financial institution, however it desires to deal with your cash. At its March announcement of Apple Card, we heard rather a lot about monetary well being, low rates of interest, cash-back percentages, and 0 charges. Details had been pretty mild then, as Apple emphasised the card’s simplicity, safety, and ease of use whereas taking broad digs on the competitors.

Now that the card has launched, we lastly have all of the laborious numbers, too. Those ultimate particulars allow us to stage a correct showdown between Apple and its hottest cash-back rivals, as a result of formidable opponents do exist—as our dive into into the nitty-gritty particulars of cash-back percentages, rates of interest, and costs exhibits.

Editor’s notice: This article initially printed March 26, 2019. We have up to date it primarily based on info now accessible upon the Apple Card’s launch in August 2019.

Apple Card vs the highest cash-back credit playing cards

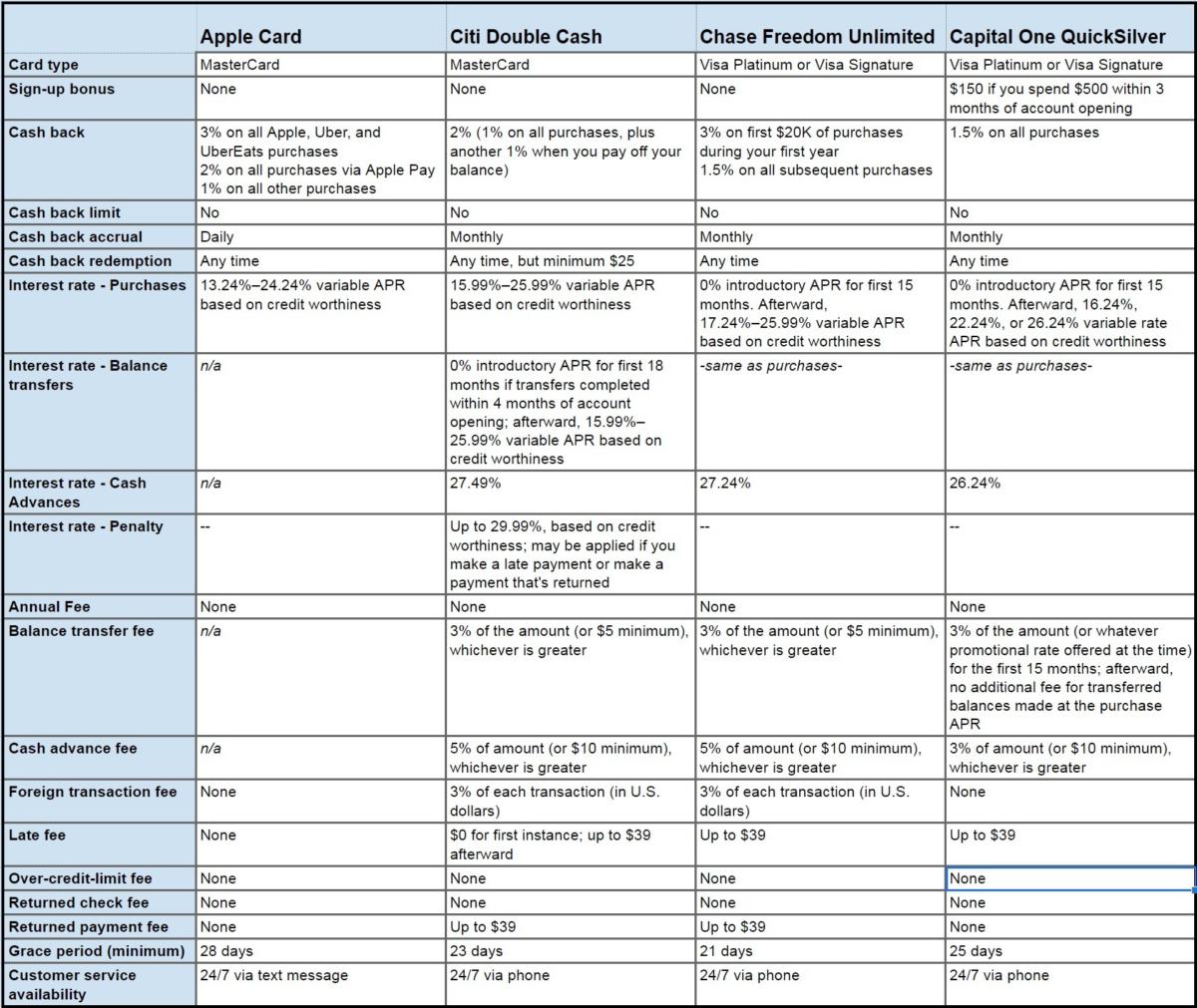

Among the preferred cash-back credit playing cards, these with probably the most related payouts to the Apple Card are the Citi Double Cash, the Chase Freedom Unlimited, and the Capital One QuickSilver. The Double Cash accrues a complete of two % money again on purchases, whereas the Freedom Unlimited and QuickSilver give again 1.5 %. All of the playing cards right here haven’t any annual charge, too, identical to the Apple Card.

Macworld

MacworldCurrently, the Apple Card doesn’t supply stability transfers or money advances.

As the chart above exhibits, not one of the non-Apple Card rivals are totally fee-free, nor are all of them that easy. Apple comes out forward on that entrance, with clear phrases and minimal penalties. It additionally neatly sidesteps the stickiness of stability transfers and money advances by not supporting them.

When you dive into the numbers to see how good of a deal the Apple Card is, you may discover that the hole between it and its rivals is not as broad as you may suppose. Since the Apple Card is a rewards-based credit card, a number of key issues makes the promise of zero charges and decrease rates of interest much less weighty.

Macworld

MacworldPurchases made with the bodily Apple Card will accrue money again at a 1 % price.

First off, you want an iPhone. Since it’s primarily based on Apple Pay, sign-up and storage is finished within the Wallet app, which is not accessible on any other machine, together with the iPad.

And then there are the precise phrases, which nonetheless line up with trade requirements. As a rewards card, the Apple Card’s variable rate of interest is larger than when utilizing a plain, non-rewards credit card. If you may’t repay your stability in full each month, you will not acquire from having a rewards credit card—the additional cash you’ll pay in curiosity obliterates the advantage of the money you’re getting again. We discovered a number of credit unions providing playing cards with rates of interest beneath 10 %, so should you battle to pay your payments on time, verify to see if there’s one in your space earlier than signing up for an Apple Card.

What’s extra, should you have a tendency to hold a stability, the Apple Card’s lowest rate of interest may…

https://www.macworld.com/article/3384257/apple-card-vs-competitors.html#tk.rss_all