Despite being the fastest growing e-commerce region with over 62% Compound Annual Growth Rate (CAGR) growth over the last 3 years, delivery continues to be a challenge in Southeast Asia, a new survey by Parcel Perform and iPrice Group reveals. The survey was conducted with 80,000 e-commerce consumers across Singapore, Malaysia, Vietnam, Thailand, and Indonesia by Parcel Perform, the leading carrier-independent e-commerce parcel tracking SaaS platform with over 600 logistics carriers.

The survey shows that 34% of Southeast Asian consumers continue to see parcel delivery as the biggest pain point in e-commerce. In addition, over 90% of customer complaints and negative feedback are related to late delivery or a lack of communication about delivery statuses.

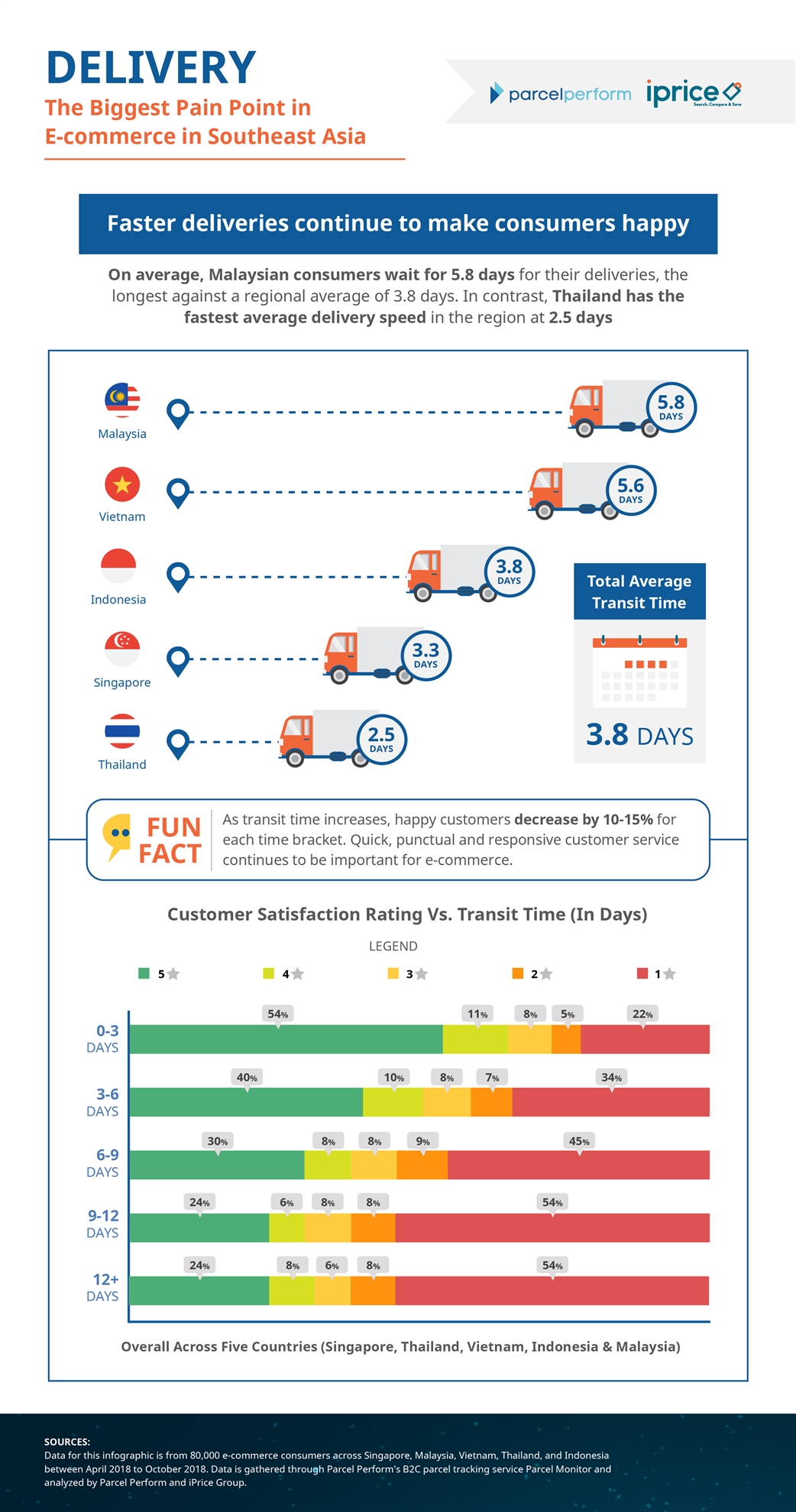

Faster deliveries continue to make consumers happy, with customer satisfaction rates decreasing as transit time increases. Comparing across countries in Southeast Asia, Singapore, Thailand, and Vietnam consumers are more satisfied with their e-commerce delivery experience as compared to Indonesia and Malaysia.

“With every parcel delivery, there is an average of 4.6 consumer touchpoints available during the delivery process. These are excellent opportunities to engage consumers after checkout. By improving the post-purchase experience customer engagement, we have seen our customers improve their customer lifetime value by 40%.” said Arne Jeroschewski, Founder and CEO, Parcel Perform.

“Due to the proliferation of options in online retail today, consumers in Southeast Asia are extremely savvy e-commerce shoppers and are increasingly more discerning when it comes to selecting when, how and who they purchase from. Besides making price comparisons across platforms, consumers are also getting more demanding in the post-purchase delivery process. Merchants will have an edge if they provide a fully visible post-purchase delivery experience with constant communication and engagement.” said Jeremy Chew, Head of Content Marketing, iPrice Group.

Here are the key findings of the study:

- Faster parcel deliveries lead to higher customer satisfaction ratings

As transit time increases, happy customers (satisfaction rating of 4-5) decrease by 10-15% for each time bracket. The direct relationship between parcel transit time and customer satisfaction ratings shows that quick, punctual and responsive customer service continues to rank high in importance towards customer satisfaction in e-commerce.

- 34% of customers in Southeast Asia are unhappy with their delivery service at present.

34% of customers are unhappy with their delivery service (satisfaction rating 1-2). Malaysia sees the most one-star ratings, followed by Vietnam and Indonesia. As customer satisfaction is a key factor for customer retention, optimizing the delivery experience is crucial to improving customer lifetime value.

- Proactively communicating with customers on expected delivery time and meeting expectations will improve customer satisfaction ratings:

Customer expectations on delivery can be managed with proactive communication and updates. Most of the one-star ratings relate to a lack of communication during the delivery period. Consumers expect regular delivery notifications, updates, and expect estimated delivery dates to be fulfilled.

- Local carriers should provide estimated delivery dates when available

Further analysis shows that the bulk of carriers with Estimated Delivery Date data are mostly international carriers who operate globally. Local carriers in Southeast Asia can take this opportunity to enhance their logistics data with estimates on delivery dates to enhance their customer satisfaction ratings.

- Over 90% of customer complaints and negative feedback are tied to transit time and late delivery.

Over 90% of customer complaints and negative feedback are related to transit time, late delivery and a lack of communication in parcel delivery status, with some complaints around the carrier’s service quality (whether the parcel is damaged while in transit and the quality of the carrier’s customer service). Positive feedback is usually shorter, with some customers using emojis to communicate. Conversely, negative feedback is more comprehensive, more emotional and longer.

Here are some interesting findings by country:

| Singapore |

|

| Malaysia |

|

| Thailand |

|

| Vietnam |

|

| Indonesia |

|