As global oil and gas companies including Malaysian Oil & Gas companies scrutinize every dollar invested, they’re spending smarter today on digital technologies, seeking to drive value and reduce costs amid low oil and gas prices, a new global survey by Accenture and Microsoft Corp. reports.

Respondents to the 2016 Oil and Gas Digital Trends Survey included international oil companies (IOCs), independents and oilfield services firms.

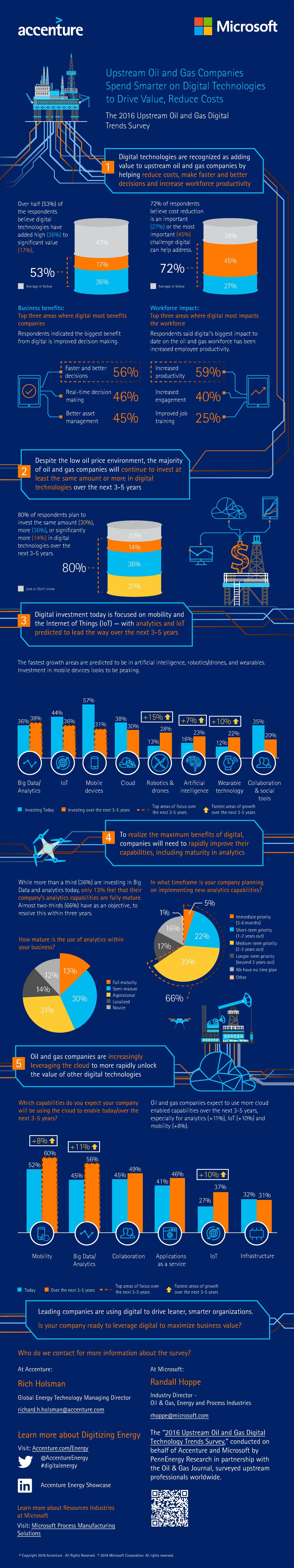

Over the next three to five years, 80 percent of oil & gas companies plan to spend the same, more, or significantly more (30%, 36%, and 14%, respectively) on digital technologies as they do now, according to the survey, now in its fifth edition. This continued investment in digital is due to respondents’ confidence that digital technologies can continue to help them drive leaner, smarter organizations.

More than half (53 percent) of respondents said digital is already adding high to significant value to their businesses. Cost reduction was identified as the biggest challenge that digital technologies can most address today, respondents said. In addition, respondents reported that making faster and better decisions was the greatest benefit digital technologies can deliver (56 percent) and that one of the biggest barriers to realizing value is the lack of a clear strategy or business case, not the technology itself.

Today’s digital investments focus more on mobility, with almost three-fifths of respondents (57 percent) reporting having invested in mobile, compared to 49 percent of the respondents in last year’s survey. Next is investing in the Internet of Things (IoT) (44 percent) this year vs. 25 percent in 2015 and the cloud (38 percent), up 8 percent from last year. Over the next three to five years, these investments are expected to shift more to big data and analytics (38 percent), IoT (36 percent) and mobile (31 percent).

The survey findings were revealed for the first time in Asia through a session involving simultaneous media briefing session for Malaysia, Indonesia, Singapore and Thailand. The same session also highlighted demonstrations of digital technologies of analytics, mobility and IoT at work in fuel retailing, plant maintenance and workforce training settings.

Lee Vee Meng, Managing Director, Accenture ASEAN Energy lead, said of the survey, “The findings put into focus very interesting developments in ASEAN where the Oil & Gas industry is using digital technologies to help them gain competitive advantage and cost efficiencies to successfully navigate the current industry and economic challenges. The better decision-making capability that comes with that investment is also helping companies position for future growth and transform into high-performance companies by identifying new business models, revenue streams and transforming the entire value chain.”

While two thirds (66 percent) of respondents identified analytics as one of the most important capabilities for transforming their company, only 13 percent felt their firm’s analytical capabilities were mature. Almost two-thirds (65 percent) plan to implement more analytic capabilities in the next three years to help address this need.

Senthil Ramani, Managing Director, Digital Business- Asia Pacific Resources and Center Director for the Accenture Internet of Things Centre of Excellence, sees this as a tremendous opportunity, “ASEAN is in an unique position to leverage digital and IOT and hence leap frog to gain competitive advantage. At our IOT center of excellence we enable clients to bridge the gap from strategy to execution of these capabilities. Many of Accenture’s clients are seeing tangible returns from their investments in areas like advanced analytics applied to maintenance, operations optimization as well as connected devices for operators and technicians.”

The survey, which was sponsored by Accenture and Microsoft and conducted by PennEnergy Research in partnership with the Oil & Gas Journal, surveyed Oil & Gas professionals worldwide, including engineers, geologists and mid-level and executive management.